The IFRS S1 and S2 Standards : What’s New & What’s to Come?

The IFRS S1 and S2 Standards: What’s New ; What’s to Come?

Share:

On 26 th June, 2023, the ISSB finally launched its inaugural sustainability standards, ushering in a new era in international corporate reporting

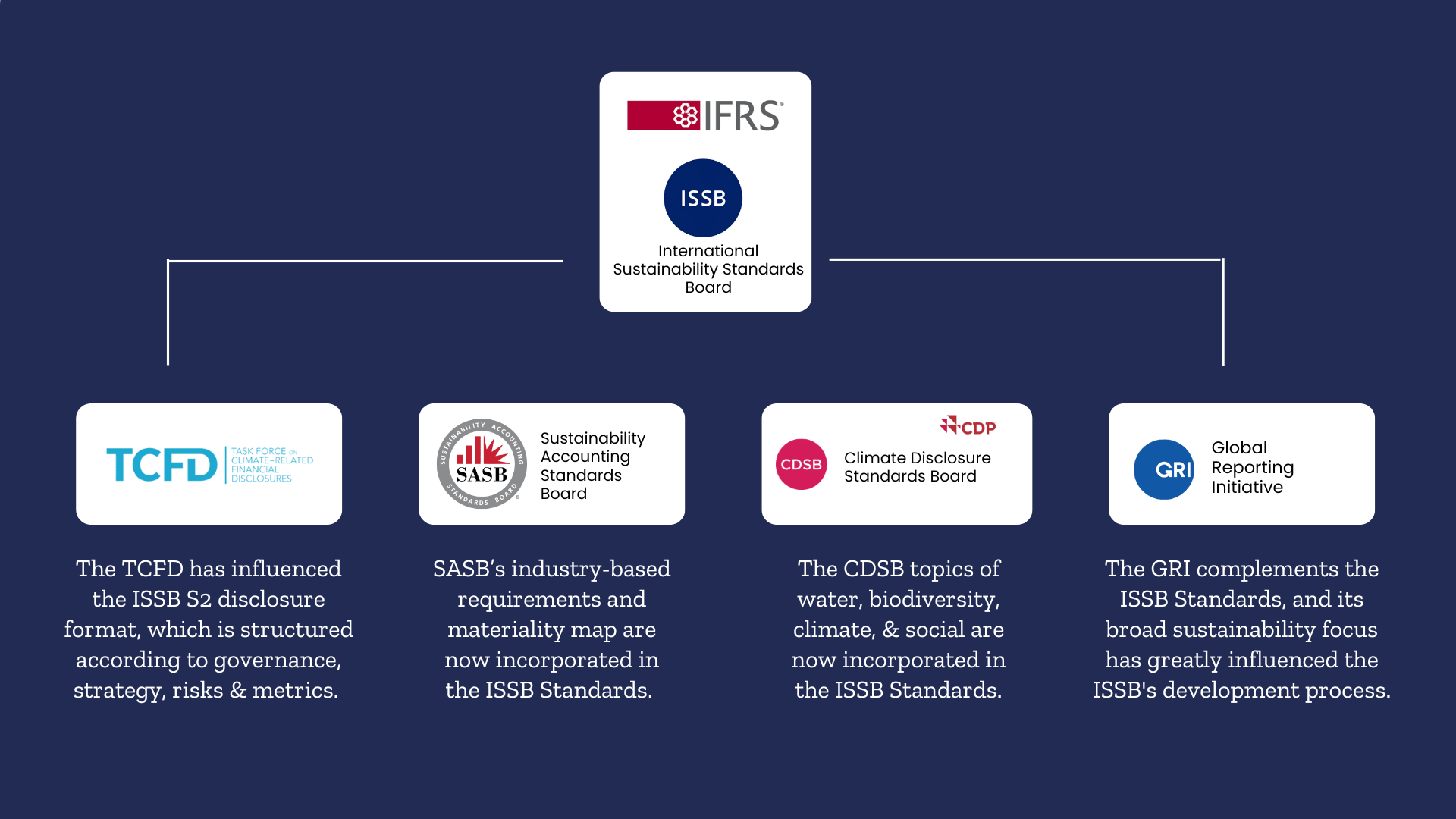

The The International Sustainability Standards Board (ISSB) has issued its first two IFRS Sustainability Disclosure Standards: the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures . Both standards fully incorporate the 4 pillars of the Task Force on Climate-related Financial Disclosures (TCFD) as well as the Sustainability Accounting Standards Board (SASB) Standards ; both are now subsumed under the ISSB as part of the efforts to establish a global baseline for sustainability reporting.

In this article, we highlight the key changes in the final S1 ; S2 standards since the 2022 drafts, explore the implications of the Standards on voluntary ; mandatory reporting, and discuss the things to expect from the ISSB in the future. For a more general overview ; introduction to the ISSB Standards, click here.

The IFRS S1 and IFRS S2: What’s New?

The IFRS S1 and IFRS S2: What’s New?

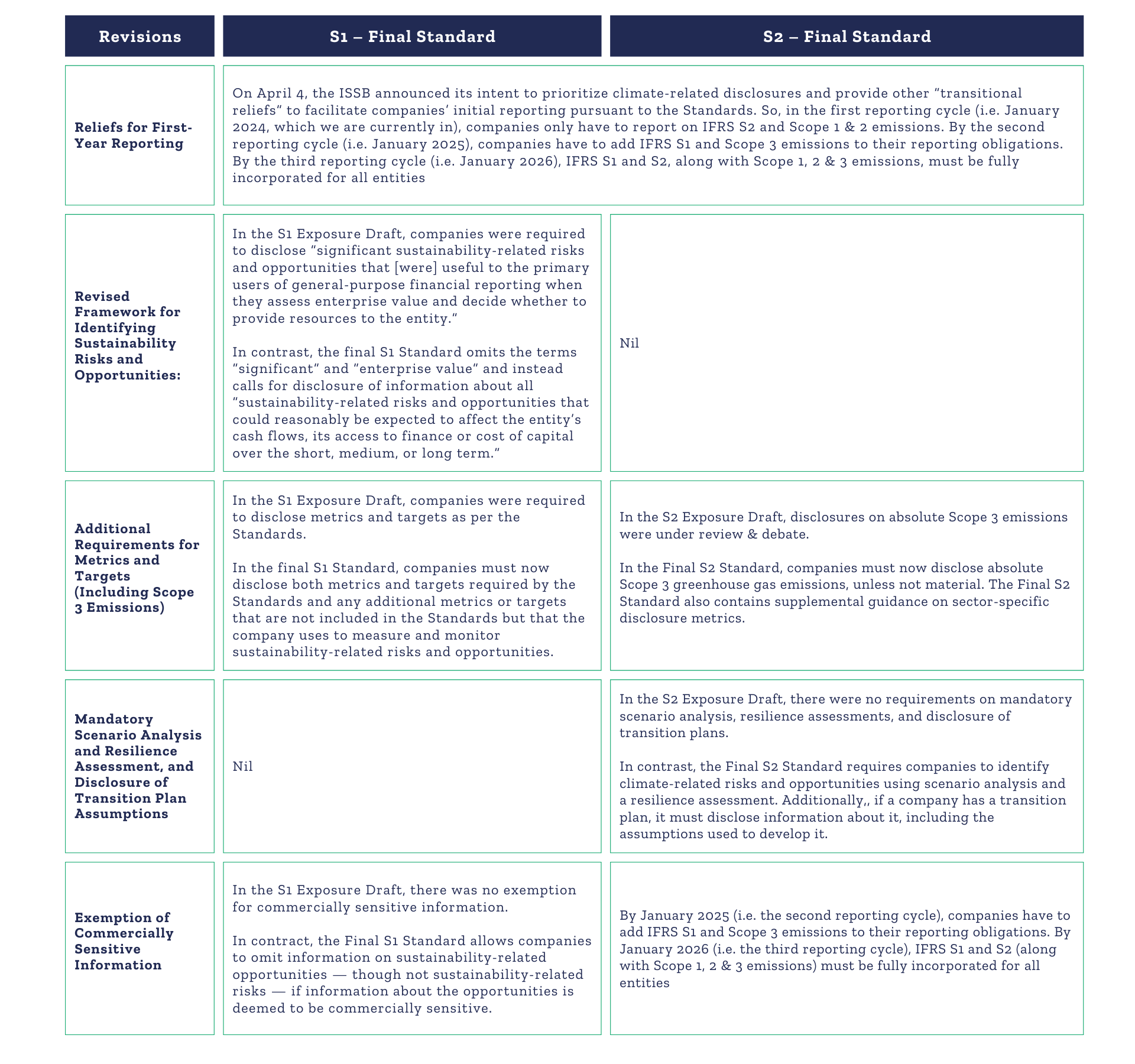

The final Standards incorporate feedback from more than 1,400 global stakeholders and contain several notable changes from the 2022 drafts (see Table 1 below):

Despite these changes, the Standards continue to lean heavily on industry-specific disclosure topics issued by the SASB and strongly align with the European Sustainability Reporting Standards (ESRS), Global Reporting Initiative (GRI), the Greenhouse Gas Protocol, and many more (see Figure 1 below).

Potential Impact of S1 ; S2 on Voluntary ; Mandatory Reporting Regimes

The fact that 1) an advisory group of prominent asset managers from around the world helped the ISSB develop its Standards, 2) influential sustainability reporting organizations like the Principles for Responsible Investment (PRI) are advocating for governments and companies to adopt ISSB-aligned reporting, and 3) the CDP’s 2024 corporate questionnaire aligns with the IFRS S2, indicates that the Standards are already shaping investor expectations and global corporate sustainability reporting.

In fact, 20 + jurisdictions (including Canada, the UK, Australia, New Zealand, China, ; Japan) are already engaged in the adoption process, and a snowball effect is now in occurring, especially since the International Organizations of Securities Commissions (IOSCO) approved the final Standards. This alone marks a breakthrough for the ISSB Standards, transforming their very nature from Voluntary to Mandatory.

What’s Next for the ISSB?

Additional Standards Forthcoming

As of 2024, the ISSB has moved forward with research projects on two key areas: biodiversity, ecosystems (including ecosystem services), and human capital. These projects were initiated based on the ISSB’s consultation on future priorities and aim to assess how risks and opportunities in these areas impact companies and investors. The ISSB is looking to build on existing frameworks, such as those from the SASB and TNFD (Taskforce on Nature-related Financial Disclosures), to develop more specific disclosure standards within these areas.

For the next two years, the ISSB’s focus will be on developing these research projects, enhancing the SASB Standards, and (most importantly) supporting the implementation of the IFRS S1 and IFRS S2.

Challenges to Adoption ; Implementation

While the shift towards Scope 3 reporting and greater climate change disclosure can improve transparency and offer investors more data to make informed decisions, companies will face infrastructural challenges to meet the Standards’ requirements. For instance, companies/financial institutions will have to conduct a substantial amount of first-time data collection in order to comply with ISSB’s data requirements. To do this successfully, they will need to radically shift ; revolutionize the way their sustainability data is collected and reported on.

The good news is that the ISSB has introduced training programmes to support those applyin g its Standards and has provided “transitional reliefs” to facilitate initial reporting. For specific details on reliefs ; adoption timeline, refer “Reliefs for First-Year Reporting” in Table 1 above. While such concessions will ease the reporting burden on many companies, smoothen the transition period, and encourage compliance, companies will still struggle with data gathering, verification, and technical compliance requirements. For companies looking to start their ISSB reporting today, it us essential for them to deploy mitigation strategies that will gear them up for the January 2024 reporting period.

While the adoption of IFRS S1 and S2 may have seemed like a long-shot when they were first introduced, it is clear that they are here and ready to be reported on. In fact, we are currently in the first reporting cycle for the IFRS S1, but there’s a lot of legwork involved in setting up internal reporting capacity. So, early adoption and early assessments are really crucial for setting up that internal capacity in the face of upcoming regulations.

About ESGTree

ESGTree helps companies gather, analyze, and report on sustainability information, greatly reducing the time and effort required to comply with investor demand and regulation. Our platform automates all major industry-leading frameworks, along with Greenhouse Gas Protocol-aligned carbon calculations, to provide a holistic ESG solution for financial institutions.

Purpose-built for private capital investors, ESGTree’s data automation solutions allow private equity and venture capital firms to gain insights into their portfolio companies’ ESG performance over time, attribute ESG data correctly, and benchmark their data to assess a portfolio company’s progress in relation to other comparable companies in the region. These insights enable investors to identify potential risks and opportunities and make informed investment decisions based on a portfolio company’s ESG performance. Our cloud-based platform and advisory services meet the needs of both seasoned ESG managers as well as those entering the world of ESG for the first time.

For more information on our ESG Reporting Solution, please contact us at :

Why ESGTree? – Differences that Make a Difference

Who Should the Economy Really Serve?

What We’ve Learned Automating the ESG Data Convergence Initiative (EDCI) for Clients

What Does the Rise of ESG Mean for Impact Investing?

Summary

Share:

Key Changes in ISSB's IFRS Standards

Understanding the IFRS S1 and IFRS S2 Standards

Potential Impact on Voluntary and Mandatory Reporting

Challenges and Solutions for Compliance

About ESGTree: Simplifying Sustainability Reporting

Contact Us

Contact Us

info@esgtree.com

Office Addresses

Canada:

ESGTree, CPA 4th Floor, 140 West mount Rd N, Waterloo,

ON N2L 3G6, Canada

United Kingdom: ESGTree, 33 Queen Street, London EC4R 1AP, United Kingdom

The post The IFRS S1 and S2 Standards : What’s New ; What’s to Come? appeared first on ESGTree .

Full content in ESGTree